On February 25, 2022, the day after Russia invaded Ukraine, Taiwan joined Switzerland, Canada, the European Union, Japan, New Zealand, the United Kingdom and the United States in immediately signing up to sanctions against Russia. However, over a year after Taiwan’s Ministry of Foreign Affairs released its statement outlining its intent to join the sanctions, costly fossil fuel imports are still arriving in Taiwan from Russia.

Data analysis provided by the Centre for Research on Energy and Clean Air (CREA) shows that last month (April 2023) Taiwan received over 170 million euros’ worth of fuel from Russia. This is down on the around 260 million euros’ worth fuel of it received in February 2022, the month the invasion began, but part of a pattern of payments that means Taiwan is, as of mid-April, the 21st-largest importer of Russian fossil fuels in 2023, according to an emailed summary from CREA. Within that it is notably the fifth-largest importer of coal, importing over 400 million euros’ worth so far this year.

Taiwan’s government set out the principle behind its support of sanctions on Russia in a Ministry of Foreign Affairs statement the day after Russia’s invasion. It wrote: “In order to compel Russia to halt its military aggression against Ukraine, and to restart peaceful dialogue among all parties concerned as soon as possible, the government of the Republic of China (Taiwan) announces it will join international economic sanctions against Russia.”

Despite much media focus on sanctions over Russian fossil fuels, when Taiwan’s Ministry of Economic Affairs signed off on official sanctions in April and May last year, they did not include fossil fuel imports. Instead, they severely restricted exports of computer and information communications products, sensors, laser goods and aerospace items. And when these sanctions were expanded in January of this year to include chemicals such as ricin, conotoxin, botulinum toxin, nitrogen trifluoride, ammonium nitrate, tributyl phosphate and nitric acid, as well as two types of stainless steel, fossil fuel imports were again not on the agenda.

The alternative focus has been on “prevent[ing] our country from exporting high-tech goods to Russia for the production of military weapons,” according to a statement from Taiwan’s cabinet made last year.

What has been happening instead of direct official action on fossil fuels is that leading importers have chosen to allow contracts with Russia to run down. Taiwan’s state owned energy company Taipower said in August last year that it had made its final payment to Russia for coal. Taiwan’s state-owned oil corporation, CPC, said in March that it would not renew contracts to buy Russian Liquified Natural Gas (LNG.)

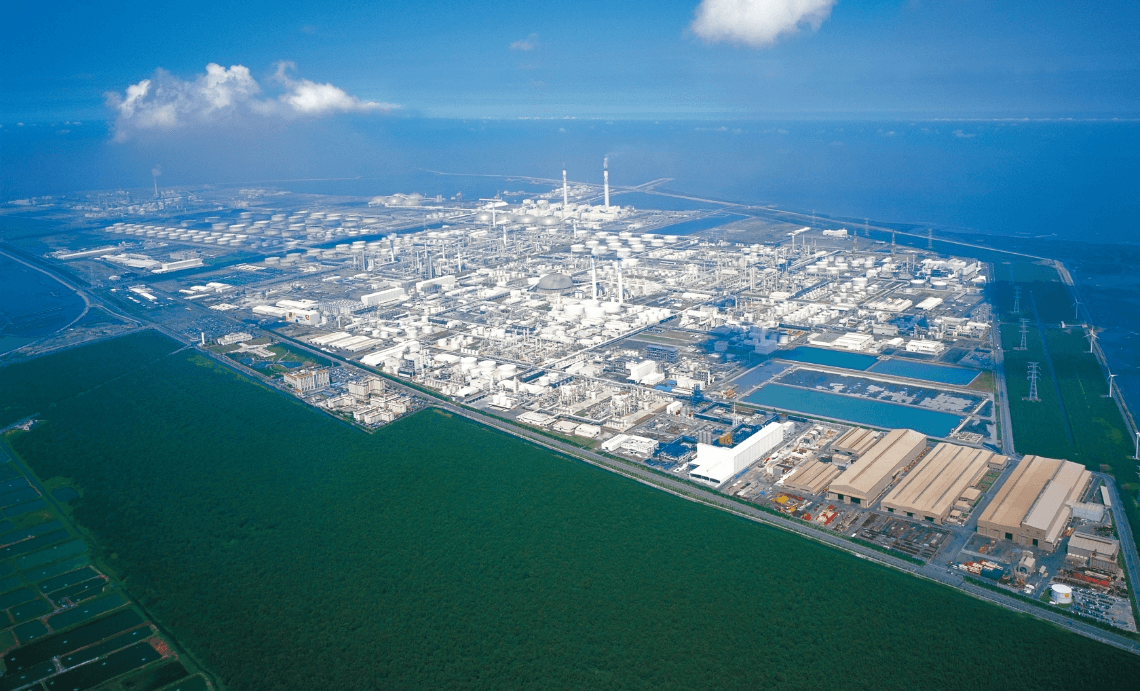

However, not every importer has made equivalent announcements. And according to CREA, citing Kpler data, “the main destinations for Russian coal in Taiwan are the Mailiao (麥寮鄕) and Ho Ping (和平) ports, which have coal power plants owned by Formosa [Petrochemical Corporation] and by the Taiwan Cement Corporation (majority owner) respectively.”

Does this situation match up to the Taiwanese government’s rhetoric? Or with those countries Taiwan has sought to position itself alongside?

The fact that the EU’s list of banned imports from Russia does not currently include LNG was likely a discussion point at the G7 summit. However, unlike Taiwan, the EU has banned fuel imports from Russia including crude oil (from December 2022) and refined petroleum products (from February 2023), with limited exceptions, plus coal and other solid fossil fuels. CREA supports this idea: “By Taiwan implementing sanctions on Russia, banning the import of Russian fossil fuels, this could help it align to its statement outlining that it would join international economic sanctions against Russia.”

This, though, remains an area full of potential disagreement, for a number of reasons.

In Taiwan’s case, energy issues are already hugely contested. Taiwan relies almost entirely on imports for its fossil fuels and it’s playing “catch up” on a green transition. At the same time as it has been decommissioning nuclear power plants, one more limitation to add to the list is likely a tough ask, politically. Furthermore, the potential replacements might be controversial too: Taiwan has increased its imports of fossil fuels from China by 23% in the first quarter of 2023 compared to the same period of the previous year, according to CREA. (With China known to be selling-on fuel from Russia, it’s possible that they are still actually buying from Russia, indirectly.)

Not everyone agrees about the efficacy of sanctions in ending the war, either. As Nicholas Mulder, author of Economic Weapon: The Rise of Sanctions as a Tool of Modern War, has described, Russia has a larger and more integrated economy than any sanctioned since before World War II. In part because of that, many people believe the results have not matched up to what was predicted before the sanctions were enacted. In March 2022, a White House fact sheet on the sanctions endorsed the Institute for International Finance’s prediction that Russia’s economy would contract by 15 percent or more in 2022, “wip[ing] out the past 15 years of economic gains in Russia.” But in February Frank Vogl, a former senior World Bank official, pointed out IMF figures pinning the real figure at just 2.2%.

Finally, there are those who believe that sanctions escalate the crisis rather than de-escalate it. Stephen Kotkin, a senior fellow at Stanford’s Freeman Spogli Institute for International Studies, told The New Yorker the following as the sanctions began to be introduced last year:

“The problem … is that it’s hard to figure out how to de-escalate, how to get out of the spiral of mutual maximalism. We keep raising the stakes with more and more sanctions and cancellations. There is pressure on our side to ‘do something’ because the Ukrainians are dying every day while we are sitting on the sidelines, militarily, in some ways. (Although, as I said, we’re supplying them with arms, and we’re doing a lot in cyber.) The pressure is on to be maximalist on our side, but, the more you corner them, the more there’s nothing to lose for Putin, the more he can raise the stakes, unfortunately. He has many tools that he hasn’t used that can hurt us. We need a de-escalation from the maximalist spiral, and we need a little bit of luck and good fortune, perhaps in Moscow, perhaps in Helsinki or Jerusalem, perhaps in Beijing, but certainly in Kyiv.”

We asked how CREA responds to the standard counterpoint to sanctions that “economic interconnectedness can be good for long-term peace,” CREA said: “Belief in economic interdependence with Russia as a stabilizing force was the guiding principle for Germany’s high level of dependence on Russia for energy imports, in particular. In reality, what happened was that Europe’s dependence on Russia lulled Putin into a sense of security, believing that Europe would not be able to take action for fear of having its energy supply disrupted. Economic interdependence only works as a deterrent against blatant violations of international law if countries are prepared to take action when such violations occur.”

Asked if CREA supports Taiwan buying coal/oil/gas from Russia again once the war in Ukraine is over, it said: “Fossil fuel exports are a key enabler of Russia’s military buildup and brutal aggression against Ukraine. Our aim is to inform politicians, policymakers, media and other stakeholders about the buyers and the sheer amount of money flowing to Russia selling its fossil fuels. By providing more transparency into the topic, we engage all stakeholders to push for actions that would block financial flows supplying the Russian war campaign as soon as possible. After the war is over, CREA would advise the investment in clean energy production rather than buying Russian or other countries fossil fuels.”

The transparency part, at least, should be easy to get behind. On the rest: There’s a lot to think about — particularly as decisions taken over Ukraine now set precedents for how other countries might think about Taiwan in the future.

Image: Formosa Plastics Group

Leave a Reply